The Interwoven Nature of Blockchain and Cryptocurrency: What Goldman Sachs and J.P. Morgan Get Wrong

Earlier this week, Jamie Dimon took center stage on CNBC to double down on his distaste for crypto, claiming “crypto-tokens are like pet rocks, [however] that doesn’t mean blockchain is not real.” Echoing the statements of Dimon, fellow banking titan David Solomon, CEO of Goldman Sachs, published similar ideas in his article “Blockchain Is Much More Than Crypto” under the umbrella of the Wall Street Journal. Solomon writes, “Cryptocurrencies are only one of blockchain’s many applications, so we shouldn’t miss the forest for the trees.” In a nutshell, what Solomon and Dimon allude to is the implementation of private blockchains - blockchains without cryptocurrency. Unfortunately for Goldman and J.P. Morgan, private blockchains are next to worthless.

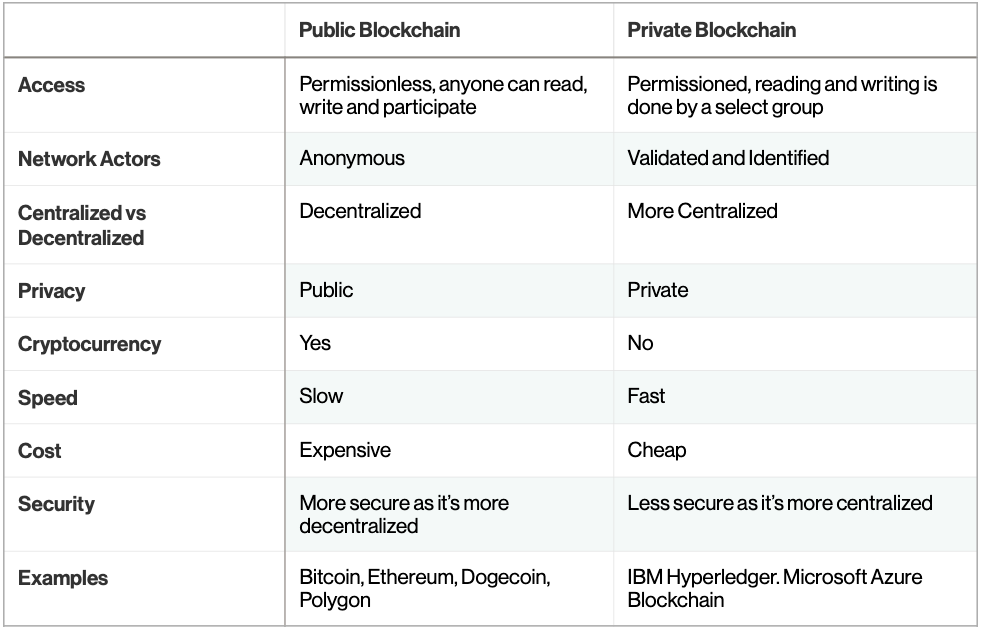

While Dimon and Solomon continue to make waves for their statements on blockchain outside of cryptocurrency, key enterprise blockchain projects at IBM and Microsoft have quietly been exiting their blockchain businesses. The reason for this is simple - blockchains without cryptocurrencies fail to deliver real value. When most people speak about private blockchain, what they really mean to say is centralized database. To understand the confusion here, let's take a quick look at a comparison between public and private blockchains. Put simply, public blockchains are permissionless, decentralized, secure, and require a native token. Private blockchains are permissioned, more centralized, less secure, and do not require a native token. The table below provides a more detailed breakdown of the key differences.

Table 1: Public Blockchain vs. Private Blockchain

To gain a deeper understanding of blockchain, let's explore the reasons behind the development of Bitcoin. After the 2008 financial crisis, the anonymous entity Satoshi Nakamoto sought to develop a new framework for financial transactions that eliminated the need for banks and other third-party intermediaries. Nakamoto’s goal was to create a network where people could conduct peer-to-peer transactions without the need for a central governing authority. He published this proposal in his whitepaper for the digital currency Bitcoin (BTC). Let’s keep in mind digital payments weren’t new; the world had moved to digital payments years prior in the form of online transactions and digital banking. Even today, whether you’re sending friends money for dinner using Venmo or buying groceries using your credit card, all these transactions are facilitated through centralized databases. The only reason one would propose the introduction of blockchain would be to facilitate decentralization - a feature diametrically opposed to the interests of large financial institutions and banking titans like Dimon and Solomon. Avivah Litan, a distinguished analyst at Gartner Research, goes on:

The value of permissioned blockchain is hard to understand since it does not implement the most revolutionary aspect of public blockchains – i.e., trust minimization and elimination of central authority, achieved via decentralized consensus.

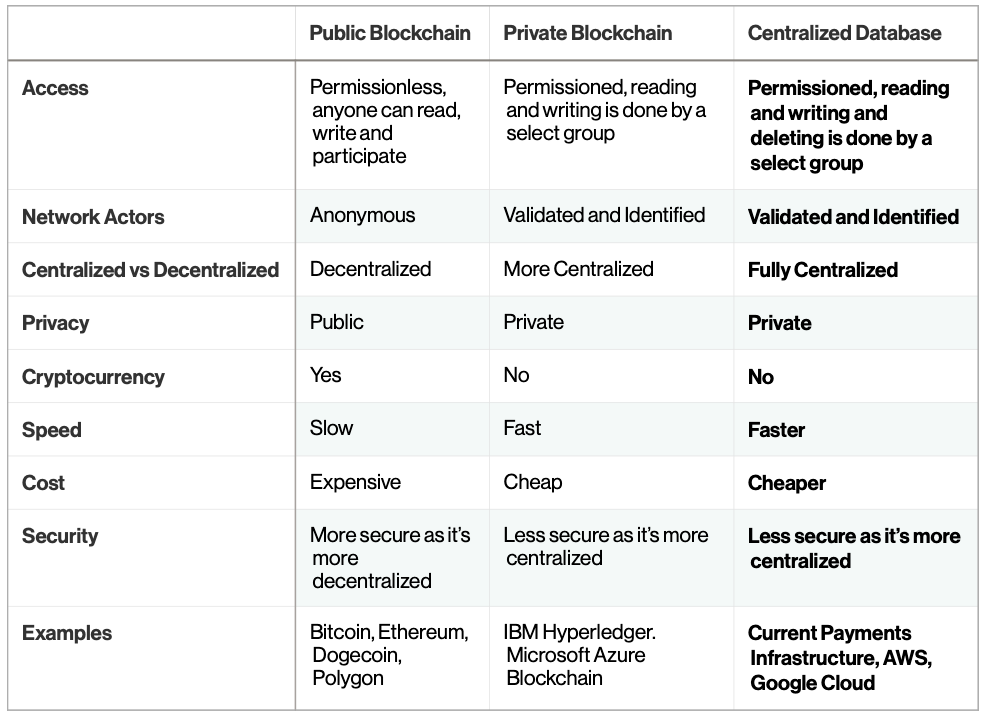

It may seem blatantly obvious, but the value of private blockchains are difficult to justify as they sever the most integral part of public blockchains - decentralization. The key reason networks have moved to blockchain technology is to enable decentralization. With private enterprise blockchains, this key benefit evaporates. Why would anyone use a private blockchain as opposed to a centralized database if they hope to create a centralized network? To see why private blockchains simply don’t make sense, let’s add centralized databases to the table.

Table 2: Public Blockchain vs. Private Blockchain vs. Centralized Database

As we can see from the comparison above, centralized databases are far more efficient than private blockchains. The only reason one would think to use a private blockchain is when the network actors are not trusted. Typically all the actors on a private blockchain are validated and identified, they’re usually trusted parties (think regulated financial institutions, global shipping companies, etc.), minimizing the need for a trustless environment. In essence, if you’re going to provide an actor with permissions to write on the blockchain, you probably trust them. Overall, centralized databases offer faster transaction times, higher throughput, lower costs, and more privacy. While private blockchains allow for immutability, it’s only achieved under certain conditions. The organization that manages the private blockchain can still override transactions. Additionally, with little decentralization, the ability to hack and endanger the entire network is increased. Hence, the efficiency, cost, and utility of a centralized database trump that of a private blockchain. Don’t believe me, hear it from Microsoft themselves in their whitepaper “Building Enterprise-grade Blockchain Applications with Azure Cosmos DB.” The paper clarifies:

“Blockchains are often complemented by databases, but in some scenarios, a database solution like Azure Cosmos DB can supply the core characteristics of the blockchain itself. Whether you’re looking for an alternative or complementary solution to blockchain technology, the Azure Cosmos DB globally distributed, multi-model database service may be the answer.”

In a 2020 study by Gartner, Litan points out:

“About 14% of [enterprise blockchain] projects made it into production, but even then transaction volume is limited. […] Those that did go into production were distributed to a limited number of nodes on the private blockchain and had very low transaction volume, calling into serious question the need for distributed ledger technology. […] These projects did not have to use a private blockchain distributed ledger technology. Instead, they could have used a centralized ledger or even a regular database.”

Earlier in 2021, Microsoft shut down its Azure Blockchain Service, citing “recent changes in the blockchain industry” and “lowered interest in the existing offering.” Microsoft retired the Service on September 10th, 2021.

Earlier this month, shipping giant Maersk shut down its TradeLens Private Blockchain initiative for tracking global shipments after four years of development. The project was developed in partnership with IBM, who are also winding down their enterprise blockchain offerings.

"The need for full global industry collaboration has not been achieved. As a result, TradeLens has not reached the level of commercial viability necessary to continue work and meet the financial expectations as an independent business. [...] I think the ROI just wasn’t there, they were spending more than they were getting back in terms of financial value. Also, IBM is no longer willing to take losses on their enterprise blockchain projects and have been gradually exiting their blockchain business.”

Let’s move back to David Solomon and our dear friends at Goldman Sachs. In his article, Solomon writes:

“Last week, using our new tokenization platform, we arranged a €100 million two-year digital bond for the European Investment Bank with two other banks, all based on a private blockchain. Typically, a bond sale like this takes about five days to settle. Ours settled in 60 seconds. By reducing settlement times, we are lowering costs for issuers, investors and regulators.”

CoinDesk reporter and ex-investment banker George Kaloudis summarizes the reason this is untrue in his article “Goldman Sachs Is Trying to Make Blockchain Bonds Happen.” Kaloudis argues:

“The reason bonds settle in five days is not because of the lack of a blockchain; it’s because of Goldman Sachs and regulation and bureaucratic red tape. Adding a private blockchain isn’t going to rid Goldman Sachs’ bond placement process of Goldman Sachs and regulation and bureaucratic red tape. Especially when that deafening call for regulation is answered.”

Now that we’ve understood why private blockchains are pointless, it’s also important to understand why cryptocurrencies are an integral part of blockchains. What makes Bitcoin, Ether, and Dogecoin an essential part of running blockchain networks? The answer is simple: incentives. Cryptocurrency rewards create the incentive structure for those who run nodes or validate transactions to support the network. In the case of Bitcoin, validators or miners solve complex mathematical equations to validate transactions on the Bitcoin network. As a reward for solving these equations, miners are rewarded in Bitcoin (BTC). It’s this structure that incentivizes people to run nodes. Without cryptocurrency rewards, there would be no reason for people to validate transactions and run the distributed set of nodes that sustain decentralized networks.

While this shows that the applications for enterprise blockchains are slim, Ethereum founder Vitalik Buterin claims there is a use case for hybrid applications and a field of potential in “auditable centralized services”. An example of this is proving solvency for exchanges, a growing concern after the collapse of the crypto exchange FTX. However, the key improvement here is the addition of public auditing - a way for customers to view the holdings of their banks publicly. While this is attractive for retail investors and the general public, it’s unsure how opaque operators such as J.P. Morgan and Goldman Sachs would benefit from such a feature.

In short, blockchains are useful for creating decentralized networks. If the goal is to develop something centralized and secure, run-of-the-mill centralized databases should do the trick. Any firms claiming they use private blockchains are simply trying to apply a very specific, cool-sounding technology to incompatible use cases. Utilizing blockchain to improve centralized banking would be similar to buying a sledgehammer to crack a nut - it’s overkill.